Roth ira earnings calculator

As of January 2006 there is a new type of 401 k -- the Roth 401 k. This calculator assumes that you make your contribution at the beginning of each year.

Traditional To Roth Ira Conversion Calculator Keep Or Convert

Invest With Schwab Today.

. Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA. Calculate your earnings and more. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Discover Bank Member FDIC. Traditional IRA Calculator can help you decide. Ad Objective-Based Portfolio Construction is Key in Uncertain Times.

Rolling Over a Retirement Plan or Transferring an Existing IRA. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Your IRA could decrease 2138 with a Roth.

Roth IRA Distribution Tool. This calculator assumes that you make your contribution at the beginning of each year. Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients.

The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. While long-term savings in a. Get The Freedom To Plan For Your Income Needs And Legacy Goals.

Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. The amount you will contribute to your Roth IRA each year. Currently you can save 6000 a yearor 7000 if youre 50 or older.

Learn How We Can Help. Traditional and Roth IRAs give you options for managing taxes on your retirement investments. This tool is intended to show the tax treatment of distributions from a Roth IRA.

The amount you will contribute to your Roth IRA each year. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Start with your modified.

Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. An IRA can be an effective retirement tool. If the amount you can contribute must be reduced figure your reduced contribution limit as follows.

This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA. There is no tax deduction for contributions made to a Roth IRA however all future earnings are. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

You can use this calculator to help you see where you stand in relation to your retirement goal and map out. Choosing between a Roth vs. The Roth 401 k allows contributions to.

Find a Dedicated Financial Advisor Now. Ad Open a Roth or Traditional IRA CD Today. Ad Do Your Investments Align with Your Goals.

The Roth IRA and the traditional IRA. For 2022 the maximum annual IRA. Ad Do Your Investments Align with Your Goals.

Not everyone is eligible to contribute this. This calculator assumes that you make your contribution at the beginning of each year. Amount of your reduced Roth IRA contribution.

Traditional IRA depends on your income level and financial goals. The amount you will contribute to your Roth IRA each year. For 2022 the maximum annual IRA.

A 401 k can be an effective retirement tool. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

Unlike taxable investment accounts you cant put an. Unfortunately there are limits to how much you can save in an IRA. That is it will show which amounts will be subject to ordinary income tax andor.

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Discover Makes it Simple. Find a Dedicated Financial Advisor Now.

You can adjust that contribution. Calculate your earnings and more. Your retirement is on the horizon but how far away.

The Roth IRA Conversion Calculator is intended to serve as an educational tool and should not be the primary basis of your investment financial or tax planning decisions. For comparison purposes Roth IRA. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

There are two basic types of individual retirement accounts IRAs.

Strata Trust Company Twitterren Use This Roth Ira Calculator To Compare The Roth Ira To An Ordinary Taxable Investment Https T Co Zkaxyfaumr Retirementplanning Https T Co 5hzwv5jvbl Twitter

Roth Ira Savings And Earning Calculator

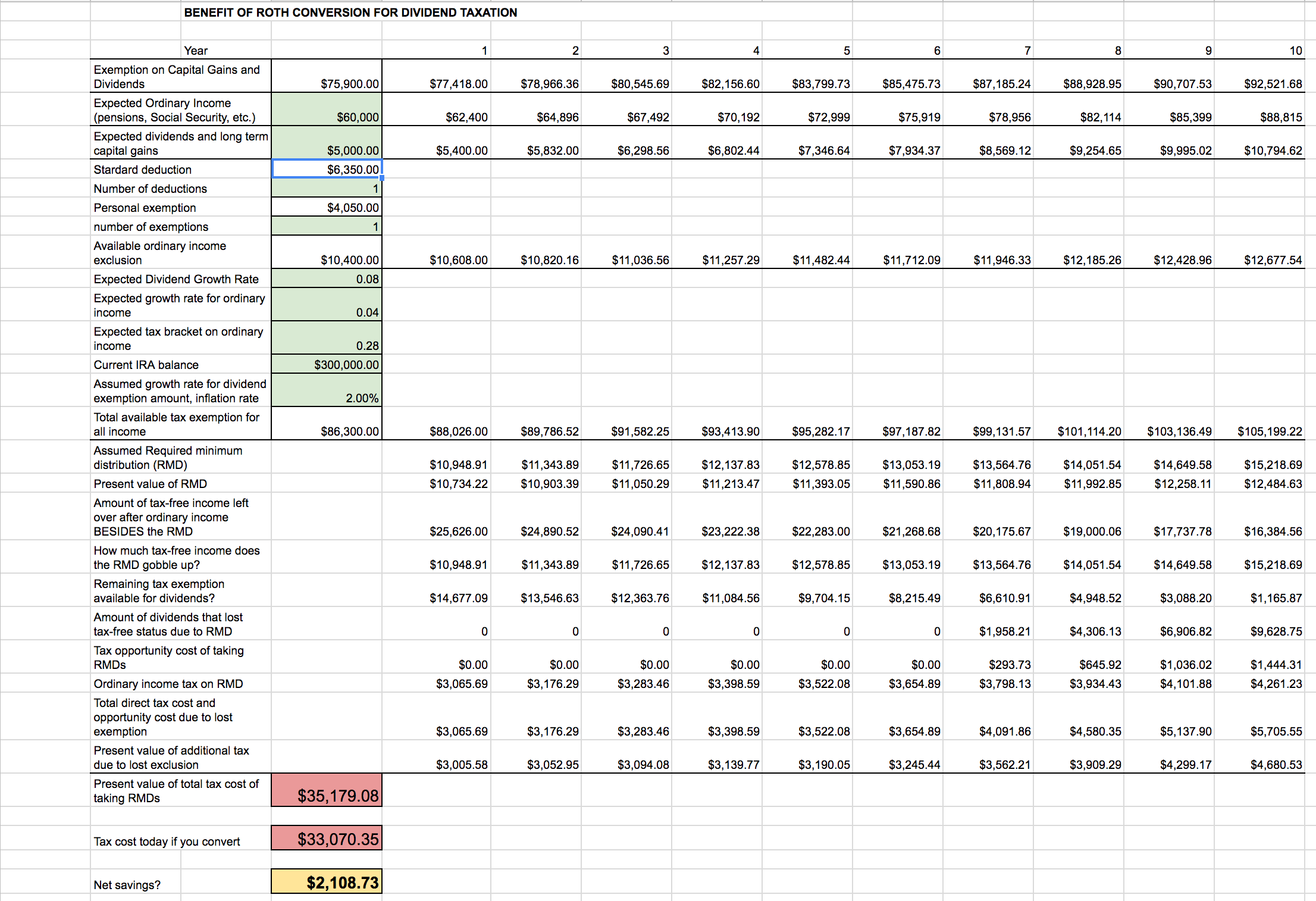

Roth Ira Conversion Spreadsheet Seeking Alpha

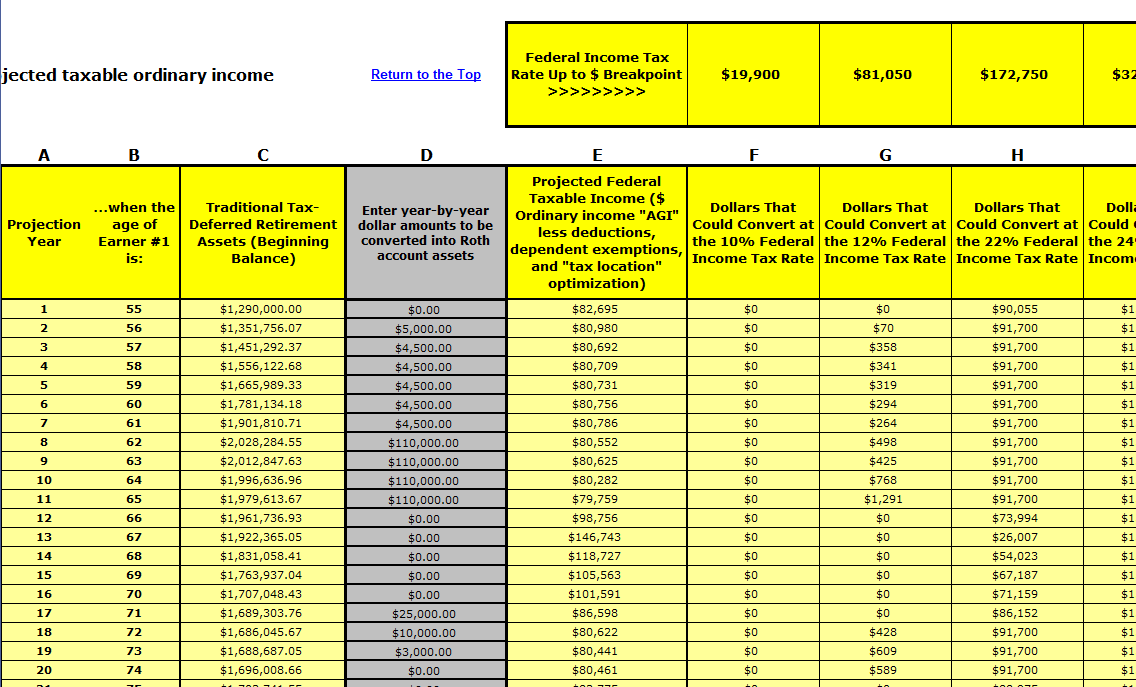

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator How Much Could My Roth Ira Be Worth

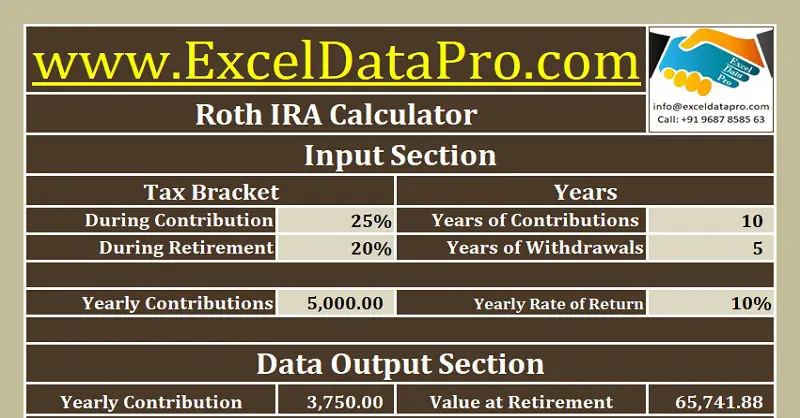

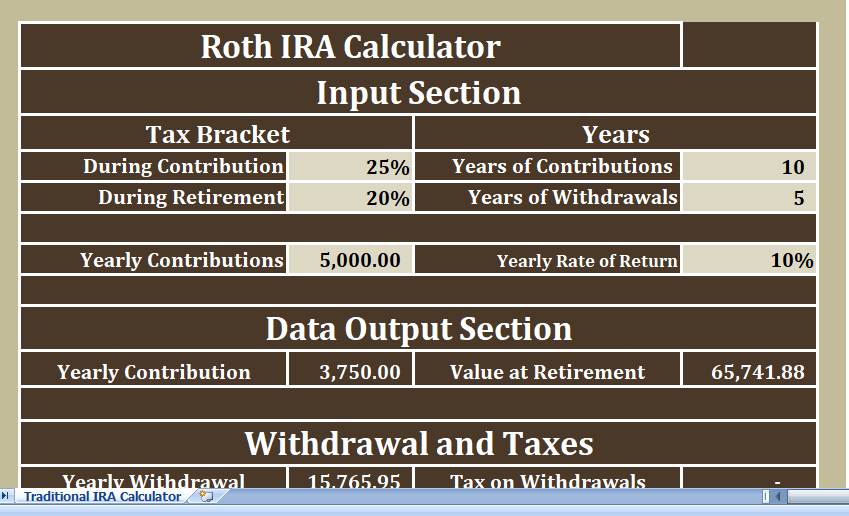

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

The Ultimate Interactive Roth Ira Calculator Blog

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Roth Ira Calculator Excel Template Exceldatapro

Roth Ira Calculator Roth Ira Contribution

Roth Ira Conversion Tax Calculator Software

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Roth Ira Calculator Excel Template For Free

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal